Delving into the realm of Narayana Hrudayalaya Share Price Insights for Global Investors, this piece invites readers with a blend of expertise and originality, promising an enlightening exploration ahead.

The subsequent paragraph will offer a detailed and informative overview of the subject matter.

Narayana Hrudayalaya Share Price Overview

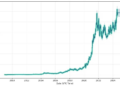

Narayana Hrudayalaya is a leading healthcare provider in India, specializing in cardiac care and other medical services. The company was founded in 2000 by Dr. Devi Shetty and has since grown to become one of the largest hospital networks in the country.Monitoring Narayana Hrudayalaya's share price is crucial for global investors as it provides insights into the financial health and performance of the company.

By tracking the share price movements, investors can gauge the market sentiment towards the company and make informed decisions about buying, selling, or holding their investments.

Factors influencing Narayana Hrudayalaya's share price movements

- The company's financial performance: Narayana Hrudayalaya's revenue growth, profitability, and earnings reports can significantly impact its share price.

- Industry trends and competition: Developments in the healthcare sector, as well as competitive pressures, can influence investor sentiment towards the company.

- Regulatory environment: Changes in regulations related to healthcare or hospitals can affect Narayana Hrudayalaya's operations and, in turn, its share price.

- Macroeconomic factors: Economic indicators, such as interest rates, inflation, and GDP growth, can impact investor confidence and overall market conditions, influencing the company's share price.

Factors Affecting Narayana Hrudayalaya Share Price

Market trends, financial performance, and recent events play crucial roles in determining Narayana Hrudayalaya's share price.

Market Trends Impact

Market trends can significantly impact Narayana Hrudayalaya's share price. Positive trends in the healthcare sector, increased demand for specialized medical services, and regulatory changes can drive the share price up. Conversely, negative trends such as economic downturns, healthcare policy changes, or increased competition may lead to a decrease in share price.

Financial Performance Influence

The financial performance of Narayana Hrudayalaya directly affects its share price. Factors like revenue growth, profit margins, debt levels, and overall profitability can sway investor sentiment and influence the stock price. Strong financial results often lead to a rise in share price, while poor performance can result in a decline.

Recent News and Events

Recent news and events can have a significant impact on Narayana Hrudayalaya's share price. Positive news such as new partnerships, expansion plans, or successful clinical trials can boost investor confidence and drive the share price higher. On the other hand, negative news like regulatory issues, lawsuits, or management changes can cause a drop in share price as investors react to uncertainties.

Narayana Hrudayalaya Share Price Comparison

When comparing Narayana Hrudayalaya's share price performance with its competitors, it is essential to consider the overall healthcare industry trends that impact its stock value in a global context. Understanding how Narayana Hrudayalaya's share price measures up against healthcare sector averages provides valuable insights for global investors.

Comparative Analysis with Competitors

- Narayana Hrudayalaya's share price can be compared to other leading healthcare providers in the industry, such as Apollo Hospitals and Fortis Healthcare.

- Analyze key financial metrics like revenue growth, profit margins, and return on investment to gauge the company's performance against its competitors.

- Consider factors like market share, geographical presence, and innovative healthcare services offered by Narayana Hrudayalaya in comparison to its rivals.

Impact of Industry Trends on Share Price

- Fluctuations in healthcare policies, advancements in medical technology, and changes in regulatory environments can significantly influence Narayana Hrudayalaya's share price.

- Global healthcare spending trends, demand for specialized medical services, and healthcare infrastructure developments can impact the company's stock performance relative to industry peers.

- Monitoring industry consolidation, competitive pricing strategies, and healthcare market dynamics is crucial for understanding how these trends shape Narayana Hrudayalaya's share price movement.

Comparison to Healthcare Sector Averages

- Evaluate Narayana Hrudayalaya's share price performance against benchmark indices like the Healthcare Select Sector SPDR Fund to assess its relative strength within the healthcare sector.

- Compare key valuation metrics such as price-to-earnings ratio, price-to-sales ratio, and earnings per share growth with sector averages to determine the company's valuation compared to industry peers.

- Consider macroeconomic factors, demographic shifts, and healthcare policy reforms that influence the overall healthcare sector performance and how Narayana Hrudayalaya's share price aligns with these trends.

Investing in Narayana Hrudayalaya Shares

Investing in Narayana Hrudayalaya shares can offer both potential risks and benefits for global investors. It is essential to evaluate the investment value of these shares carefully and consider various factors before making a decision. Here are some strategies and tips to help investors interested in including Narayana Hrudayalaya shares in their portfolio.

Potential Risks and Benefits

- One potential risk of investing in Narayana Hrudayalaya shares is the volatility of the healthcare sector, which can be influenced by regulatory changes, economic conditions, and competitive pressures.

- On the other hand, one of the benefits of investing in Narayana Hrudayalaya shares is the growth potential of the company, given its focus on providing affordable healthcare services in emerging markets.

- Global investors should also consider currency fluctuations and geopolitical risks when investing in Narayana Hrudayalaya shares.

Strategies for Evaluating Investment Value

- Conduct thorough research on Narayana Hrudayalaya's financial performance, management team, competitive positioning, and growth prospects.

- Utilize valuation metrics such as price-to-earnings ratio, price-to-sales ratio, and discounted cash flow analysis to assess the intrinsic value of Narayana Hrudayalaya shares.

- Consider diversification within the healthcare sector and across different geographies to mitigate risks associated with investing in Narayana Hrudayalaya shares.

Tips for Global Investors

- Stay informed about the latest developments in the healthcare industry and how they may impact Narayana Hrudayalaya's business operations and financial performance.

- Regularly review and adjust your investment portfolio to ensure it aligns with your risk tolerance, investment goals, and time horizon.

- Consult with financial advisors or investment professionals who have expertise in the healthcare sector to get personalized advice on investing in Narayana Hrudayalaya shares.

Last Recap

Concluding this discourse on Narayana Hrudayalaya Share Price Insights for Global Investors, the summary encapsulates key points in a compelling manner, leaving readers with a lasting impression.

Essential FAQs

What is the significance of monitoring share prices for global investors?

Monitoring share prices helps investors make informed decisions, understand market trends, and assess the performance of their investments.

What are the potential risks and benefits of investing in Narayana Hrudayalaya shares for global investors?

Investing in Narayana Hrudayalaya shares can offer growth opportunities but carries risks like market volatility and industry-specific challenges.

How does Narayana Hrudayalaya's share price compare to healthcare sector averages?

Narayana Hrudayalaya's share price may vary from sector averages due to company-specific factors and market dynamics.