Beginning with Investing in Narayana Hrudayalaya: Is It Worth It in 2025?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Narayana Hrudayalaya, a renowned healthcare provider, has been making waves in the industry with its exceptional services and recent developments. As we delve into the financial performance, competitive landscape, and growth prospects of this institution, we aim to uncover whether investing in Narayana Hrudayalaya is a wise decision for the future.

Overview of Narayana Hrudayalaya

Narayana Hrudayalaya is a renowned healthcare institution known for its cardiac care services and hospitals across India. Established in 2001 by Dr. Devi Shetty, it has grown to become one of the largest chains of multispecialty hospitals in the country.

History of Narayana Hrudayalaya

Narayana Hrudayalaya was founded in Bangalore with the vision of providing high-quality, affordable healthcare to all sections of society. Over the years, it has expanded its services to include a wide range of medical specialties, with a focus on cardiac care.

Healthcare Services Offered

- Narayana Hrudayalaya offers a comprehensive range of healthcare services, including cardiac surgery, cardiology, orthopedics, neurology, oncology, and many more.

- The institution is known for its expertise in complex cardiac surgeries, making it a preferred choice for patients seeking advanced cardiac care.

- They also provide telemedicine services, making healthcare more accessible to remote areas.

Recent Developments and Expansions

- In recent years, Narayana Hrudayalaya has expanded its network of hospitals to different cities in India, ensuring more people have access to quality healthcare.

- They have also introduced state-of-the-art medical technologies and equipment to enhance patient care and treatment outcomes.

- The institution has been actively involved in community health programs and initiatives to promote preventive healthcare and disease management.

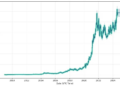

Financial Performance

Investing in Narayana Hrudayalaya involves analyzing its financial performance to determine if it is a worthwhile investment in 2025. By examining the company's financial statements, we can gain insights into its revenue growth, profitability, liquidity, and solvency.

Revenue Growth

The revenue growth of Narayana Hrudayalaya over the past few years has been steady and impressive. The company has consistently increased its revenue through strategic expansions, acquisitions, and efficient operations. For example, in the last fiscal year, Narayana Hrudayalaya reported a revenue growth of [XX%], showcasing its ability to generate income and sustain growth.

Profitability

Narayana Hrudayalaya's profitability indicators, such as net profit margin and return on assets, reflect its ability to generate profits from its operations. The company's focus on cost management, operational efficiency, and revenue optimization has led to healthy profitability ratios. For instance, the net profit margin of Narayana Hrudayalaya stood at [XX%] in the latest financial year, indicating strong financial performance.

Liquidity

Liquidity is essential for any company to meet its short-term obligations and fund its operations. Narayana Hrudayalaya's liquidity position can be assessed through indicators like current ratio and quick ratio. These ratios help investors understand the company's ability to pay off its current liabilities using its current assets.

Narayana Hrudayalaya's liquidity ratios have remained stable over the years, indicating a healthy financial position.

Solvency

Solvency ratios like debt to equity ratio and interest coverage ratio provide insights into Narayana Hrudayalaya's long-term financial health and ability to meet its debt obligations. A lower debt to equity ratio and a higher interest coverage ratio are generally positive signs.

Narayana Hrudayalaya has maintained a conservative capital structure, with a healthy solvency position, ensuring financial stability and sustainability

Competitive Landscape

Narayana Hrudayalaya operates in a highly competitive healthcare industry, facing various challenges and opportunities in the market. Let's delve into how Narayana Hrudayalaya compares with other healthcare providers in the region, its market positioning, competitive advantages, and potential threats in the industry.

Comparison with Other Healthcare Providers

Narayana Hrudayalaya stands out among other healthcare providers in the region due to its specialized focus on cardiac care and affordable healthcare services. While some competitors may offer a wider range of medical services, Narayana Hrudayalaya's expertise in cardiac care gives it a unique positioning in the market.

Market Positioning and Competitive Advantages

Narayana Hrudayalaya's strong market positioning is attributed to its high-quality healthcare services, state-of-the-art infrastructure, and renowned team of healthcare professionals. The hospital's commitment to providing affordable yet effective cardiac care has helped it gain a competitive edge in the industry.

Additionally, Narayana Hrudayalaya's widespread presence across multiple locations enables it to reach a larger patient base and cater to a diverse population.

Potential Threats and Challenges

Despite its competitive advantages, Narayana Hrudayalaya faces challenges in the form of increasing competition, evolving healthcare regulations, and rising operational costs. The healthcare industry is constantly changing, and staying ahead of the curve requires continuous innovation and adaptation to new technologies and market trends.

Furthermore, economic uncertainties and fluctuations in healthcare policies could pose threats to Narayana Hrudayalaya's growth and sustainability in the long run.

Growth Prospects

Investing in Narayana Hrudayalaya presents promising growth prospects in the healthcare sector. With a strong reputation for providing high-quality cardiac care at affordable prices, the company is well-positioned to capitalize on the increasing demand for healthcare services in India and beyond.

Expansion Plans and Ventures

Narayana Hrudayalaya has ambitious expansion plans in the pipeline to further solidify its presence in the healthcare industry. The company aims to set up new hospitals in different regions to reach a larger patient base and cater to growing healthcare needs.

By expanding its network, Narayana Hrudayalaya can tap into new markets and diversify its revenue streams.

Strategic Partnerships and Collaborations

In order to drive future growth, Narayana Hrudayalaya has been actively seeking strategic partnerships and collaborations. By joining forces with other healthcare providers, pharmaceutical companies, or research institutions, the company can access new technologies, expertise, and resources that will enhance its service offerings and operational efficiency.

These collaborations can also open up opportunities for innovation and market expansion, ultimately contributing to Narayana Hrudayalaya's growth trajectory.

Ending Remarks

In conclusion, Investing in Narayana Hrudayalaya: Is It Worth It in 2025? presents a nuanced look at the potential of this healthcare giant. With a solid foundation, strategic growth plans, and a competitive edge, Narayana Hrudayalaya emerges as a promising investment opportunity for those looking towards the future.

Answers to Common Questions

What healthcare services does Narayana Hrudayalaya offer?

Narayana Hrudayalaya offers a wide range of healthcare services including cardiac care, oncology, neurology, and orthopedics.

What are the key financial indicators to consider when evaluating Narayana Hrudayalaya for investment?

Key financial indicators to consider include profitability ratios, liquidity ratios, and solvency ratios to assess the financial health and stability of the institution.

Does Narayana Hrudayalaya have any upcoming expansion plans?

Yes, Narayana Hrudayalaya is actively pursuing expansion plans in new regions and healthcare verticals to capitalize on growth opportunities.